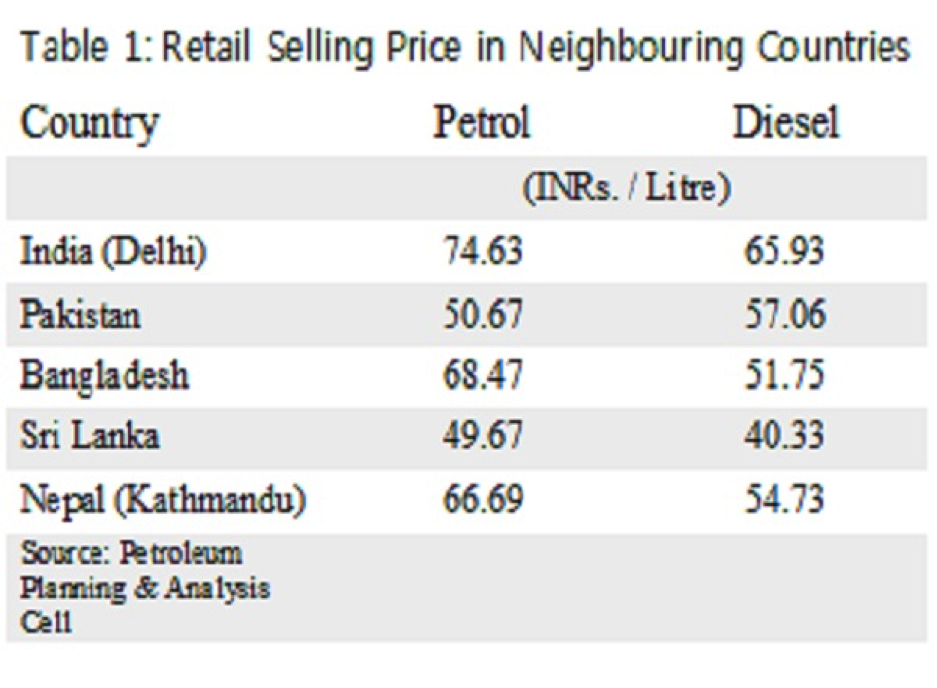

The price rise in general and of oil, in particular, was one of the reasons for the anger against the UPA government. While the crude oil prices were quite high during UPA-2 (USD 106.85 per barrel in May 2014 before the UPA demitted office), they have fallen dramatically over the better part of the tenure of Modi government (in the range of USD 30s). Yet the trend of retail prices is exactly the opposite. Of course, for the Indian public, it is the price of crude oil in INR and not dollars which matters. If the rupee gets weaker against the dollar, as it has during the current government, the Indian consumers receive limited benefits from the declining international oil prices.

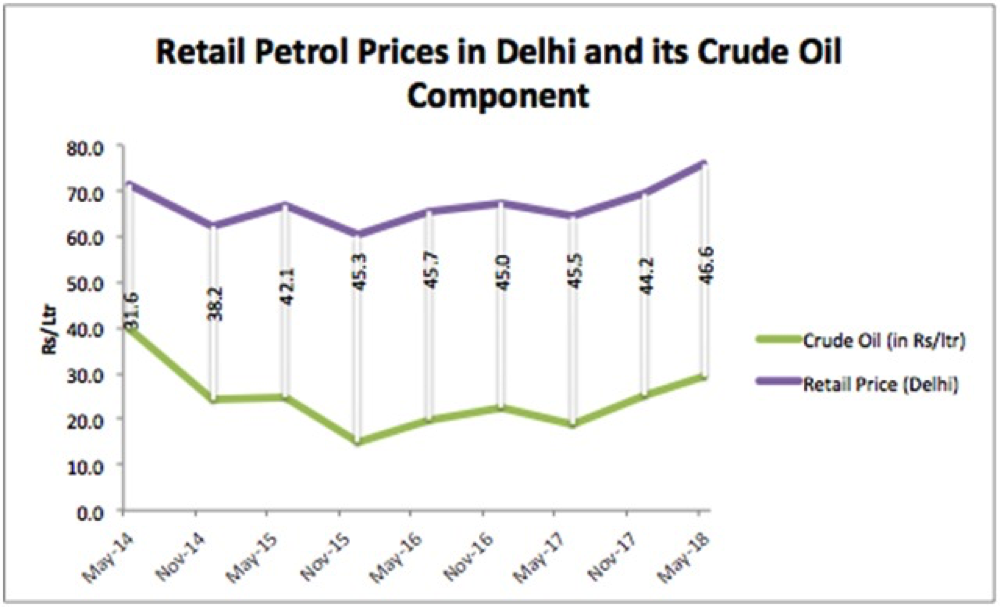

So, what portion of the Rs 80 we pay for a litre of petrol go towards the purchase of crude oil? The difference between the retail price and the crude oil price comprise the taxes levied by the government, refining charges and the profit margins of the oil retailers in India. This difference is a burden on ordinary citizens since it measures what part of the fall in the international prices goes into the coffers of the government or the oil oligarchs instead of being passed on to the consumers. In the figure given below, it is evident that this burden is currently about 50 per cent higher than it was in May 2014 (Rs. 46.6/ltr now as opposed to Rs. 31.6/ltr earlier). This is because of an inbuilt asymmetry in retail pricing.

While a rise in crude oil prices is borne by the consumers, the benefit of a fall is not passed on to them, and if at all it is then only marginally so. Between May 2014 and Dec 2015, the crude oil cost fell from Rs 40 to Rs 15 per litre, whereas the retail prices fell only by Rs 11 per litre. On the other hand, an increase in crude oil prices has been matched by an equivalent, at times greater, rise in retail prices. The result is a paradoxical situation, where instead of reducing the role of the government in petrol and diesel pricing, deregulation of oil prices in India has done the exact opposite.

The price rise in general and of oil, in particular, was one of the reasons for the anger against the UPA government. While the crude oil prices were quite high during UPA-2 (USD 106.85 per barrel in May 2014 before the UPA demitted office), they have fallen dramatically over the better part of the tenure of Modi government (in the range of USD 30s). Yet the trend of retail prices is exactly the opposite. Of course, for the Indian public, it is the price of crude oil in INR and not dollars which matters. If the rupee gets weaker against the dollar, as it has during the current government, the Indian consumers receive limited benefits from the declining international oil prices.

So, what portion of the Rs 80 we pay for a litre of petrol go towards the purchase of crude oil? The difference between the retail price and the crude oil price comprise the taxes levied by the government, refining charges and the profit margins of the oil retailers in India. This difference is a burden on ordinary citizens since it measures what part of the fall in the international prices goes into the coffers of the government or the oil oligarchs instead of being passed on to the consumers. In the figure given below, it is evident that this burden is currently about 50 per cent higher than it was in May 2014 (Rs. 46.6/ltr now as opposed to Rs. 31.6/ltr earlier). This is because of an inbuilt asymmetry in retail pricing.

While a rise in crude oil prices is borne by the consumers, the benefit of a fall is not passed on to them, and if at all it is then only marginally so. Between May 2014 and Dec 2015, the crude oil cost fell from Rs 40 to Rs 15 per litre, whereas the retail prices fell only by Rs 11 per litre. On the other hand, an increase in crude oil prices has been matched by an equivalent, at times greater, rise in retail prices. The result is a paradoxical situation, where instead of reducing the role of the government in petrol and diesel pricing, deregulation of oil prices in India has done the exact opposite.

Source: Petroleum Planning & Analysis Cell, Author’s calculation

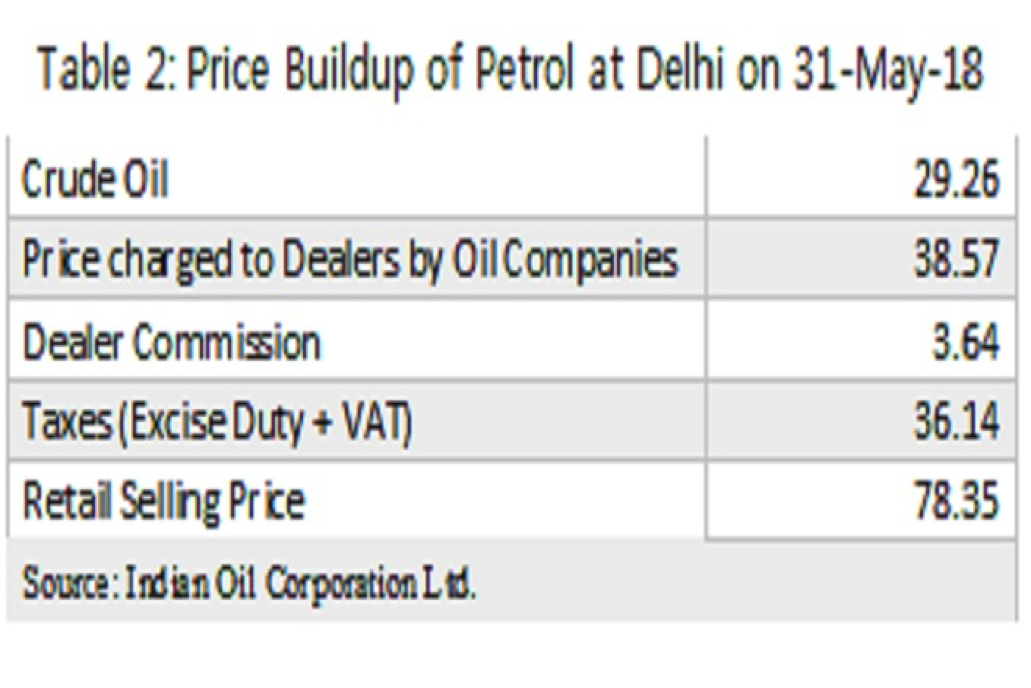

But who’s inflicting this burden, in other words, who’s pocketing this gap? Indian Oil Corporation provides latest data on the breakup of retail prices which shows the share of the government in the overall price paid by the consumers (table 2). Close to half of what we pay goes as taxes to the government (central and state combined).

There are broadly two arguments being made by the government about high oil prices. First, the oil prices are high because state governments are greedy.

If the state governments can be persuaded to bring the taxes down, the price of oil can be brought under control. A look at the division of oil tax revenues between central and state exchequer, however, presents a different picture.

Source: Petroleum Planning & Analysis Cell, Author’s calculation

But who’s inflicting this burden, in other words, who’s pocketing this gap? Indian Oil Corporation provides latest data on the breakup of retail prices which shows the share of the government in the overall price paid by the consumers (table 2). Close to half of what we pay goes as taxes to the government (central and state combined).

There are broadly two arguments being made by the government about high oil prices. First, the oil prices are high because state governments are greedy.

If the state governments can be persuaded to bring the taxes down, the price of oil can be brought under control. A look at the division of oil tax revenues between central and state exchequer, however, presents a different picture.

First, data from Petroleum Planning & Analysis Cell shows that in the first year of Modi government, the petroleum sector contributed equally to the state and the central kitty. But since 2015, it has contributed one and a half times more to the central exchequer than to the states. Moreover, even if this claim of the government were true, which it is not, majority of the states have the same ruling party as the centre (as the party in power repeatedly reminds us). Does passing the buck to the state governments reduce the accountability of the central government?

Second, the government claims that these tax revenues are critical to the social sector spending. Any cut in taxes would mean a cut in such spending, which will hurt the poor etc. This argument is riddled with holes. One, indirect taxes, unlike the direct taxes, are not redistributive. The incidence of indirect taxes falls equally on all consumers, whether rich or poor. In other words, poor people shell out a greater proportion of their income than the rich to pay for these taxes. As a result, the government is extracting more from the poor through indirect taxes than it is spending on their wellbeing. Moreover, a government, whose priority is to give relief to the corporates is under continuous pressure to decrease corporate taxes. The ensuing gap in resource mobilisation targets is increasingly filled by indirect taxes, which is a regressive trend when it comes to redistribution.

Two, a cut in spending as a result of a fall in the revenue is a self-inflicted limit, which derives its legitimacy from fiscal conservatism which has engulfed the world economy in the form of austerity measures. Why would a government choose to do so in conditions of slow growth and an economy running below capacity is difficult to understand.

Three, higher indirect taxes on an essential good such as oil means stoking inflation in the economy from the cost side. While the Modi government hasn’t seen inflation at the levels of the UPA-2 years, if it continues milking the oil cow, a future rise in crude oil prices can affect the fortunes of this government too.

(The Author is Assistant Professor at Centre for Economic Studies and Planning in Jawaharlal Nehru University, New Delhi. Article courtesy: newscentral24*7.com)

First, data from Petroleum Planning & Analysis Cell shows that in the first year of Modi government, the petroleum sector contributed equally to the state and the central kitty. But since 2015, it has contributed one and a half times more to the central exchequer than to the states. Moreover, even if this claim of the government were true, which it is not, majority of the states have the same ruling party as the centre (as the party in power repeatedly reminds us). Does passing the buck to the state governments reduce the accountability of the central government?

Second, the government claims that these tax revenues are critical to the social sector spending. Any cut in taxes would mean a cut in such spending, which will hurt the poor etc. This argument is riddled with holes. One, indirect taxes, unlike the direct taxes, are not redistributive. The incidence of indirect taxes falls equally on all consumers, whether rich or poor. In other words, poor people shell out a greater proportion of their income than the rich to pay for these taxes. As a result, the government is extracting more from the poor through indirect taxes than it is spending on their wellbeing. Moreover, a government, whose priority is to give relief to the corporates is under continuous pressure to decrease corporate taxes. The ensuing gap in resource mobilisation targets is increasingly filled by indirect taxes, which is a regressive trend when it comes to redistribution.

Two, a cut in spending as a result of a fall in the revenue is a self-inflicted limit, which derives its legitimacy from fiscal conservatism which has engulfed the world economy in the form of austerity measures. Why would a government choose to do so in conditions of slow growth and an economy running below capacity is difficult to understand.

Three, higher indirect taxes on an essential good such as oil means stoking inflation in the economy from the cost side. While the Modi government hasn’t seen inflation at the levels of the UPA-2 years, if it continues milking the oil cow, a future rise in crude oil prices can affect the fortunes of this government too.

(The Author is Assistant Professor at Centre for Economic Studies and Planning in Jawaharlal Nehru University, New Delhi. Article courtesy: newscentral24*7.com)

Moody’s survey shows oil prices as the main risk to India’s economy |

| The Hindu Oil prices, pace of banks’ balance sheet clean-up and investment remain the key credit risks in India, according to an investor survey by Moody’s Investors Service. While market participants in Singapore and Mumbai were unanimous in pegging high crude price as the main risk to India’s economy, views varied on the second biggest risk, according to the ratings agency. “When asked about the top risks facing the Indian economy, most of the respondents highlighted high oil prices as the top risk, while 30.3% of those in Singapore picked rising interest rates as the next top risk, and 23.1% of those in Mumbai picked domestic political risks as the second top risk,” Joy Rankothge, a vice president and senior analyst at Moody’s, said in a press release. Participants at Moody’s 4th Annual India Credit Conference, conducted by the credit ratings agency along with its Indian affiliate ICRA Ltd. in Mumbai and Singapore in June 2018, were polled on some of the most pressing credit issues facing India. Almost 175 people representing more than 100 local and international financial institutions attended the conference, Moody’s said. |